Introduction

In the ever-evolving landscape of cryptocurrency, altcoins have emerged as a pivotal element, offering diverse opportunities and challenges for traders. While Bitcoin continues to dominate headlines, a multitude of altcoins are gaining traction, each with unique features and potential for growth.

This article delves into effective trading strategies for these alternative digital currencies, providing both novice and experienced traders with the insights needed to navigate this complex yet rewarding market.

Understanding Altcoins

Altcoins, or ‘alternative coins,’ are cryptocurrencies other than Bitcoin. They emerged as enhancements or variations of Bitcoin, introducing new features, functionalities, or consensus mechanisms.

Popular altcoins like Ethereum, Litecoin, and Ripple have carved their niches, offering different utilities. Ethereum, for instance, is renowned for its smart contract functionality, while Ripple is favored for its fast and efficient cross-border payment solutions.

Fundamentals of Altcoin Trading

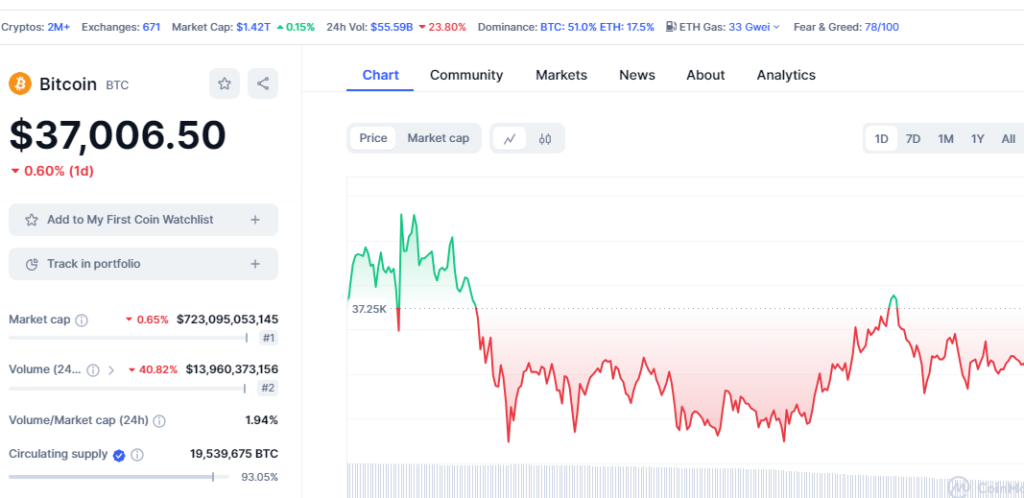

Trading altcoins requires an understanding of both technical and fundamental analysis. Technical analysis involves examining charts and patterns to predict future price movements, while fundamental analysis looks at external factors and the intrinsic value of the coin. Key market trends and indicators like volume, price history, and recent news should be closely monitored to make informed decisions.

Diverse Trading Strategies

Each trader has a unique approach, but some common strategies include:

- Day Trading: This strategy involves buying and selling altcoins within a single trading day. Day traders capitalize on short-term price movements and require a good grasp of market trends.

- Swing Trading: This longer-term strategy focuses on capturing gains over a few days to several weeks. Swing traders need to identify and act upon significant market trends.

- Scalping: Scalpers make numerous trades to profit from small price changes, often holding assets for minutes or hours.

- Long-term Investment: Some traders prefer holding altcoins for extended periods, banking on their long-term potential.

Risk Management in Altcoin Trading

Effective risk management is key to successful trading. Setting stop-loss orders can protect against significant losses, and diversifying your portfolio can spread risk. Never invest more than you can afford to lose, and always stay informed about market changes.

Tools and Resources for Altcoin Trading

Numerous platforms and tools are available to assist traders. These range from exchanges like Binance and Coinbase to news outlets providing the latest crypto insights. Staying updated with market analysis and trends is crucial for making informed trading decisions.

Advanced Tips and Tricks

Experienced traders often use bots and automated systems to execute trades based on specific criteria. Arbitrage, the simultaneous buying and selling of an asset to profit from price differences across exchanges, can also be a lucrative strategy.

Common Pitfalls and How to Avoid Them

Emotional trading can lead to rash decisions. Developing a disciplined trading strategy and sticking to it is vital. Stay informed and always research before making any trading decisions.

Conclusion

Altcoin trading offers exciting opportunities but comes with its challenges. By understanding the market, employing effective strategies, and managing risks, traders can navigate this dynamic field successfully.

Ready to dive deeper into the world of altcoin trading