Introduction to Crypto Trading

Discover beginner-friendly tips for crypto trading. Navigate the market, manage risks, and start your investment journey with confidence This guide is your companion on a journey to navigate the cryptocurrency market with confidence.

Understanding the Crypto Market

Before you dive into trading, it’s crucial to get a lay of the land.

Market Volatility

Cryptocurrency markets are notorious for their swift and unpredictable price movements. Understanding volatility is the first step toward making informed decisions.

Types of Cryptocurrency

Bitcoin, Ethereum, and Ripple are just the tip of the iceberg. We’ll explore the various kinds of digital currencies and what makes each unique.

Setting Up for Success

Proper setup is the cornerstone of any successful trading endeavour.

Choosing a Trading Platform

With countless platforms available, we’ll help you select one that fits your needs like a glove.

Creating a Trading Plan

A well-structured trading plan is your roadmap to success. We’ll guide you through establishing achievable goals and milestones.

Risk Management

The golden rule of trading: don’t risk more than you can afford to lose. We’ll cover strategies to protect your capital.

Analyzing Crypto Trends

The ability to analyze market trends separates the amateurs from the pros.

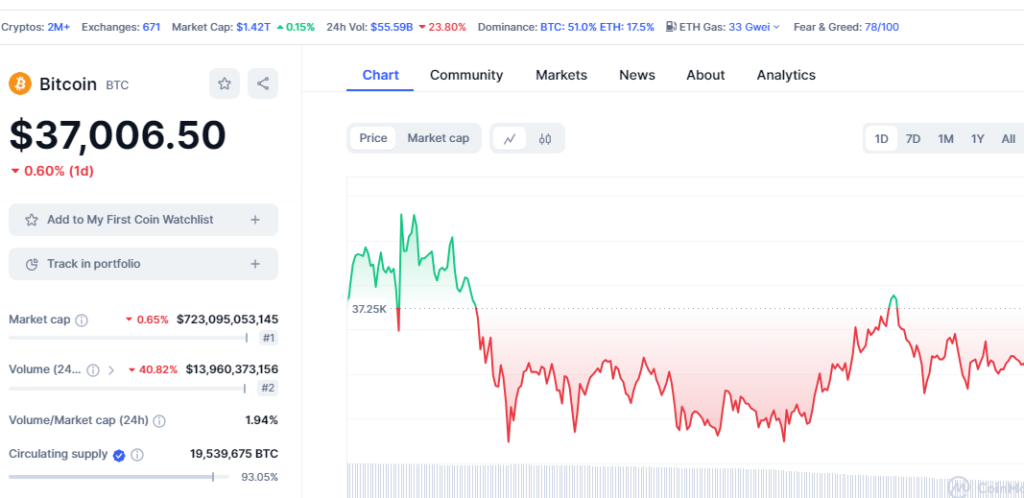

Technical Analysis

Charts and graphs are not just lines and dots; they tell the story of the market’s past and present.

Fundamental Analysis

Beyond the charts, understanding the underlying factors that affect crypto prices is key.

Effective Trading Strategies

There’s no one-size-fits-all in trading, but we’ll explore strategies that have stood the test of time.

Day Trading

Fast-paced and hands-on, day trading is for those who can dedicate time and focus to the markets.

Swing Trading

For those with a bit more patience, swing trading involves taking advantage of market “swings” over days or weeks.

Scalping

Quick and frequent trades can add up to significant gains for the eagle-eyed trader.

Leveraging Trading Tools

Trading tools can give you an edge, making your trading efficient and strategic.

Trading Bots

Automation is your friend. Trading bots can save time and help enforce discipline.

Crypto Wallets

Secure storage for your digital assets is not just important; it’s essential.

Common Pitfalls to Avoid

Even experienced traders can fall prey to common mistakes.

Emotional Trading

The market has no emotions, and neither should you when making trading decisions.

Overtrading

More trades don’t necessarily mean more profits. We’ll discuss finding the right balance.

Staying Informed and Educated

The crypto landscape is ever-changing. Staying informed is non-negotiable.

Continual Learning

The learning never stops in crypto trading. We’ll point you to resources that will keep you on top of your game.

Utilizing Resources

From forums to newsletters, the right resources can provide invaluable insights.

Diversification in Crypto Trading

Don’t put all your coins in one wallet. We’ll explain why diversification can be your safety net. Certainly, let’s continue the article.

Understanding Crypto Trading Platforms

Choosing the right platform is a foundational step in your trading journey. As a beginner, look for platforms that offer user-friendly interfaces and robust educational resources. Coinbase and Binance are two examples that cater to newcomers with their intuitive designs and comprehensive tutorials.

Security Measures in Crypto Trading

Security should never be an afterthought when dealing with digital assets. Ensure that the platform you choose employs rigorous security protocols such as two-factor authentication (2FA), end-to-end encryption, and cold storage for the majority of funds.

Starting Small and Scaling Up

There’s wisdom in the adage, “Don’t put all your eggs in one basket,” especially in the volatile world of crypto. Begin with small investments to test the waters and gradually increase your exposure as you gain more experience and confidence.

Diversification is Key

Diversifying your portfolio is critical in managing risk. Instead of investing solely in Bitcoin or Ethereum, consider spreading your investment across different assets. This can potentially cushion the blow should one cryptocurrency perform poorly.

Staying Informed

The cryptocurrency market is influenced by a myriad of factors, including technological advancements, regulatory news, and market sentiment. Staying updated through reliable news sources and forums can give you an edge in making informed trading decisions.

Using Technical Analysis

Technical analysis involves studying charts and patterns to forecast future price movements. While it may seem daunting at first, there are numerous resources available to help beginners understand and apply these principles.

Emotional Discipline

Trading can be an emotional rollercoaster. It’s important to maintain discipline and not let fear or greed dictate your decisions. Setting clear entry and exit strategies can help mitigate emotional responses to market fluctuations.

Conclusion: Embracing the Learning Curve

Embarking on the journey of crypto trading is an exciting venture. Remember, every expert was once a beginner. With patience, perseverance, and a willingness to learn, you can navigate the complex waters of cryptocurrency trading.

Utilize these tips and tricks as a starting point, and never stop seeking knowledge. Happy trading!