Analytical views of the upcoming bullish season

Bitcoin has been a hot topic in the financial world for quite some time now. Since its inception in 2009, it has grown in popularity and value, with many investors and traders jumping on the bandwagon. However, the cryptocurrency market can be quite volatile, and predicting Bitcoin’s price can be a challenging task. In this article, we will explore the current Bitcoin market situation and analyze the trading patterns to predict its future price.

Understanding Bitcoin (BTC) is essential to predict its price. Bitcoin is a decentralized digital currency that uses encryption techniques to regulate the generation of units of currency and verify the transfer of funds. It operates independently of a central bank and is based on a peer-to-peer network. The value of Bitcoin is determined by supply and demand, just like any other currency or commodity.

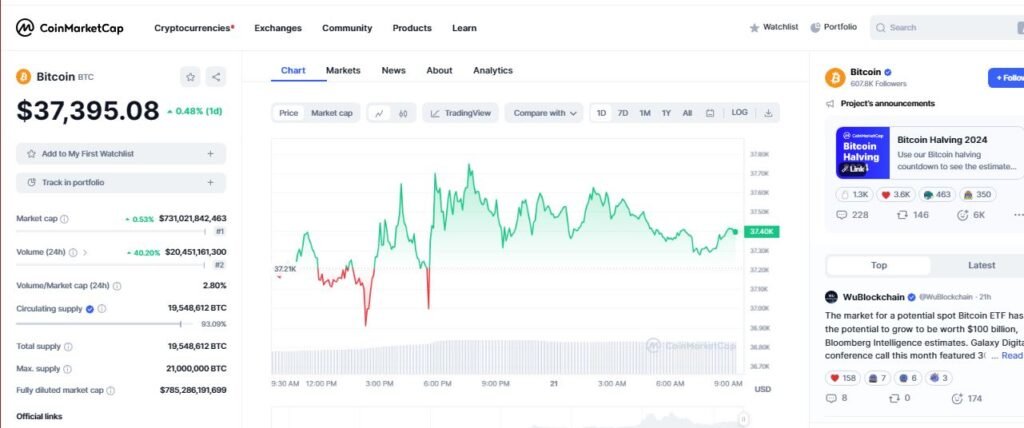

Current BTC/USD Market Situation: BTC/USD is currently showing bullish signals, with the crypto seeing multiple strong uptrends and selloffs. According to CryptoSignals, the key resistance levels for Bitcoin are $42,000, $44,000, and $46,000, while the support levels are $32,000, $30,000, and $18,000. In the next section, we will analyze the BTC trading patterns and market sentiments to predict its future price.

Key Takeaways

- Understanding Bitcoin is essential to predict its price.

- BTC/USD is currently showing bullish signals.

- Analyzing trading patterns and market sentiments can help predict Bitcoin’s future price.

Understanding Bitcoin (BTC)

Bitcoin (BTC) is a decentralized digital currency that operates on a peer-to-peer network. It is not backed by any government or financial institution, and its value is determined by the market demand and supply. Bitcoin is the most popular and widely used cryptocurrency, and its price has been highly volatile over the years.

How Bitcoin Works

Bitcoin transactions are recorded on a public ledger called the blockchain, which is maintained by a network of computers. When you send BTC to someone else, the transaction is verified by the network and added to the blockchain. This process is called mining, and it involves solving complex mathematical problems to validate transactions and create new BTC.

Advantages of Bitcoin

Bitcoin offers several advantages over traditional currencies and payment systems. For one, it is decentralized, meaning that it is not controlled by any central authority. This makes it more resistant to censorship and government interference. Additionally, Bitcoin transactions are fast and cheap, and they can be made anonymously without revealing your identity.

Risks of Bitcoin

Despite its many advantages, Bitcoin is not without its risks. Its value is highly volatile, and it can fluctuate wildly in short periods of time. This makes it a risky investment for those who are not willing to take on high levels of risk. Additionally, Bitcoin is not widely accepted as a form of payment, and it can be difficult to find merchants who accept it.

Overall, Bitcoin is a fascinating and innovative technology that has the potential to revolutionize the way we think about money and finance. However, it is important to understand the risks and benefits associated with it before investing your hard-earned money.

Current BTC/USD Market Situation

If you’ve been keeping up with the daily Bitcoin price charts, you may have noticed a recent uptrend in the cryptocurrency market. The BTC/USD pair has been showing bullish signals, with the price bouncing off the lower channel of the medium-term uptrend on the 4-hour chart. The daily chart also shows a potential breakout from the sideways trading range, with the price currently testing the upper channel resistance level.

Despite the recent selloff in the crypto markets, Bitcoin has managed to maintain its value and market cap. The Bitcoin market capitalization has grown to over $1 trillion, making it one of the most valuable cryptocurrencies in the market. The total supply of Bitcoin is limited to 21 million, with the current circulating supply at around 18.8 million BTC.

The recent volatility in the crypto markets has led to increased interest in Bitcoin as a store of value, with many investors turning to cryptocurrency as a hedge against inflation and economic uncertainty. This has led to a rally in the Bitcoin price, with the cryptocurrency reaching new all-time highs in recent months.

As the SEC continues to review Bitcoin ETF proposals, many investors are hopeful that the approval of a BTC ETF will lead to increased institutional adoption and a further increase in the Bitcoin price.

Overall, the current BTC/USD market situation is looking positive, with the cryptocurrency showing bullish signals and maintaining its value and market cap despite the recent selloff in the crypto markets. However, as with any investment, it’s important to do your own research and seek out financial advice before making any decisions.

That’s all for now on the current BTC/USD market situation. Stay tuned for more crypto news and updates on the latest developments in the cryptocurrency market.

BTC Trading Analysis

If you are a trader looking to invest in BTC/USD, it is important to conduct a thorough trading analysis to assess the market trends and identify potential risks. Technical analysis is a popular tool used by traders to evaluate the market trends and make informed trading decisions.

One of the key indicators to consider is the moving average, which helps to identify the direction of the market trend. The 21-day moving average is a popular choice among traders, as it provides a good balance between short-term and long-term trends.

Another important indicator to consider is the Relative Strength Index (RSI), which helps to identify overbought and oversold conditions in the market. A reading above 70 indicates overbought conditions, while a reading below 30 indicates oversold conditions.

The Moving Average Convergence Divergence (MACD) is another popular indicator that traders use to identify potential trend reversals. A bullish MACD crossover occurs when the MACD line crosses above the signal line, indicating a potential upward trend.

In terms of support and resistance levels, traders should pay attention to the key levels such as $35,000 and $40,000. These levels have been tested multiple times in the past and are likely to provide strong support and resistance.

It is also important to consider the trading volume when analyzing the market trends. High trading volume indicates that there is a strong market interest in BTC/USD, which can lead to potential price movements.

Overall, conducting a technical analysis can help you to make informed trading decisions and minimize the risk associated with BTC/USD trading. However, it is important to keep in mind that trading experience and analytics are equally important in making successful trades.

Market Sentiments

The Bitcoin price chart has been showing bullish signals recently. This means that the market sentiment is optimistic and investors are feeling confident about the future of BTC/USD. The bullish trend is characterized by a sustained upward movement in prices, which indicates that there is a lot of buying pressure in the market.

However, it is important to note that there are still some bears in the market who are exerting bearish pressure on the price of Bitcoin. These bears believe that the current bullish movement is unsustainable and that the price of BTC/USD will eventually come crashing down. It is important to keep an eye on the bearish movement and to be aware of any signs of a reversal in the trend.

Despite the bearish pressure, the overall market sentiment remains bullish. This is due to a number of factors, including the increasing adoption of Bitcoin by mainstream investors and the growing interest in cryptocurrencies as an alternative investment asset. Additionally, the recent approval of a Bitcoin ETF in Canada has also contributed to the bullish sentiment in the market.

If you are considering investing in Bitcoin, it is important to keep an eye on the market sentiment and to be aware of any potential risks. While the current trend is bullish, there is always the possibility of a reversal, so it is important to stay informed and to make informed investment decisions.

Investors and Bitcoin

If you are an investor looking to invest in cryptocurrency, Bitcoin is one of the most popular digital currencies to consider. Bitcoin has a market cap of approximately $1.2 trillion and has been steadily increasing in value over the years.

Investors who are interested in Bitcoin should consider their buying zone carefully. The buying zone is the price range in which an investor should consider buying Bitcoin. It is important to note that the buying zone can vary depending on market conditions and the investor’s risk tolerance.

Funds management is another important factor to consider when investing in Bitcoin. Investors should allocate a portion of their portfolio to Bitcoin and other cryptocurrencies based on their risk tolerance and investment goals. It is recommended to diversify your portfolio to mitigate risks.

Investors should also keep an eye on the market trends and news related to Bitcoin. This will help them make informed investment decisions. It is important to note that Bitcoin is a volatile asset and its price can fluctuate rapidly. Therefore, investors should be prepared to hold their investment for the long term to realize gains.

In conclusion, Bitcoin is a popular digital currency that offers potential for high returns but also carries risks. Investors should carefully consider their buying zone, funds management, and market trends before investing in Bitcoin.

Predicting Bitcoin Price

If you’re looking to predict the price of Bitcoin, there are various factors you should consider. One of the most important is technical indicators. Technical indicators are mathematical calculations based on the price and/or volume of a security. They can help traders and investors identify trends and patterns in the market and make more informed decisions.

Some of the most commonly used technical indicators for Bitcoin price prediction include moving averages, relative strength index (RSI), and Bollinger Bands. Moving averages are used to smooth out price fluctuations and identify trends. RSI is used to measure the strength of a trend and identify potential reversal points. Bollinger Bands are used to measure volatility and identify potential support and resistance levels.

When using technical indicators for Bitcoin price prediction, it’s important to keep in mind that they are not foolproof. They are just one tool in a trader’s toolbox and should be used in conjunction with other analysis techniques.

Another factor to consider when predicting Bitcoin price is market sentiment. Market sentiment refers to the overall attitude of traders and investors towards a particular security. If the market sentiment is bullish, it means that traders and investors are optimistic about the future price of Bitcoin. If the market sentiment is bearish, it means that traders and investors are pessimistic about the future price of Bitcoin.

To gauge market sentiment, you can look at various sources such as social media, news articles, and online forums. However, it’s important to keep in mind that market sentiment can change quickly, so it’s important to stay up-to-date with the latest news and trends.

Overall, predicting the price of Bitcoin is a complex and challenging task. It requires a deep understanding of the market, as well as a willingness to adapt to changing conditions. By using technical indicators and monitoring market sentiment, you can increase your chances of making accurate predictions and making informed trading decisions.

Frequently Asked Questions

What is the projection for BTC USD?

Bitcoin’s value is highly volatile and can fluctuate in response to various factors, including market trends, investor sentiment, and government regulations. While it is difficult to predict the exact price of Bitcoin, some analysts believe that the cryptocurrency will continue to rise in value in the long term. According to a recent Bitcoin price prediction, BTC/USD is showing bullish signals and could potentially reach resistance levels of $42,000, $44,000, and $46,000.

Is BTC bearish or bullish?

Currently, Bitcoin is showing bullish signals, which suggests that the cryptocurrency is likely to continue its upward trajectory. However, it is important to note that the market can be highly unpredictable, and Bitcoin’s value can fluctuate rapidly in response to various factors.

What is the forecast for Bitcoin BTC?

The forecast for Bitcoin BTC is largely dependent on market trends, investor sentiment, and other factors that can impact the cryptocurrency’s value. While some analysts predict that Bitcoin will continue to rise in value in the long term, others believe that the cryptocurrency could experience significant fluctuations in the coming months and years.

How much will 1 Bitcoin be worth in 2030?

It is difficult to predict the exact value of Bitcoin in 2030, as the cryptocurrency market can be highly unpredictable. While some analysts believe that Bitcoin will continue to rise in value in the long term, others predict that the cryptocurrency could experience significant fluctuations in the coming years.

Bitcoin price prediction chart

Bitcoin price prediction charts can be useful tools for investors who are looking to make informed decisions about buying and selling cryptocurrency. These charts can provide valuable insights into market trends, investor sentiment, and other factors that can impact Bitcoin’s value.

btc price prediction today, tomorrow

Bitcoin price predictions for today and tomorrow can be found on various websites and social media platforms. However, it is important to keep in mind that these predictions are based on various factors that can impact Bitcoin’s value and may not always be accurate. As such, it is important to conduct thorough research and analysis before making any investment decisions.