Free Crypto Signals Channel

Get exclusive access to expert insights and analysis with our Free Crypto Signals Channel. Stay ahead in the crypto trading game with real-time updates, trend predictions, and actionable trade signals tailored for both beginners and seasoned traders.

What are Crypto Pairs?

Understanding crypto pairs is fundamental in the crypto trading world. A crypto pair forms a market between two types of currencies, typically involving a cryptocurrency and a fiat currency (like USD) or two cryptocurrencies (like BTC and ETH). These pairs reflect the value of one currency relative to another and are the basic units of trading in the crypto world.

Fiat-to-Crypto Pairs

Fiat-to-crypto pairs link a traditional currency, such as the US Dollar, Euro, or British Pound, with a cryptocurrency like Bitcoin or Ethereum. These pairs, such as BTC/USD, are gateways for entering the crypto market from the traditional financial world and are crucial for converting your fiat holdings into digital assets.

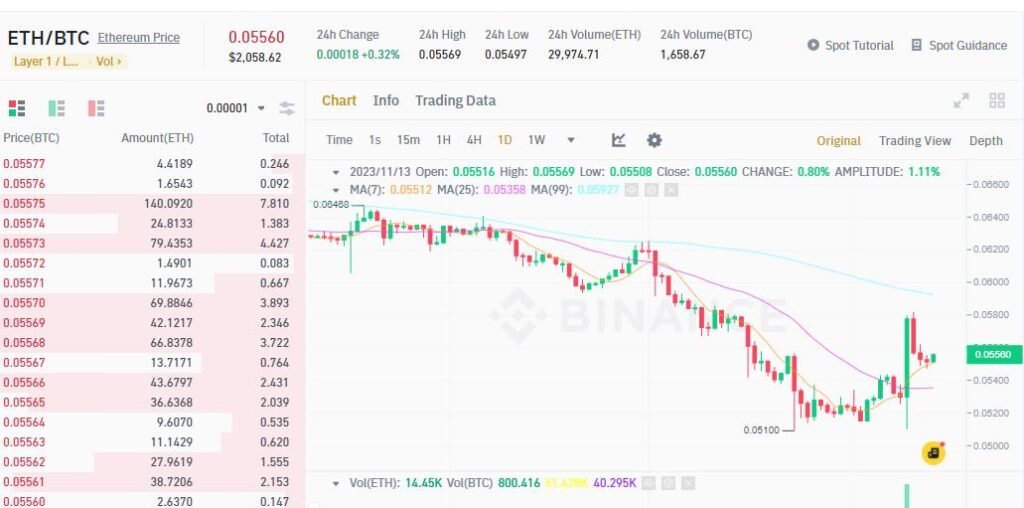

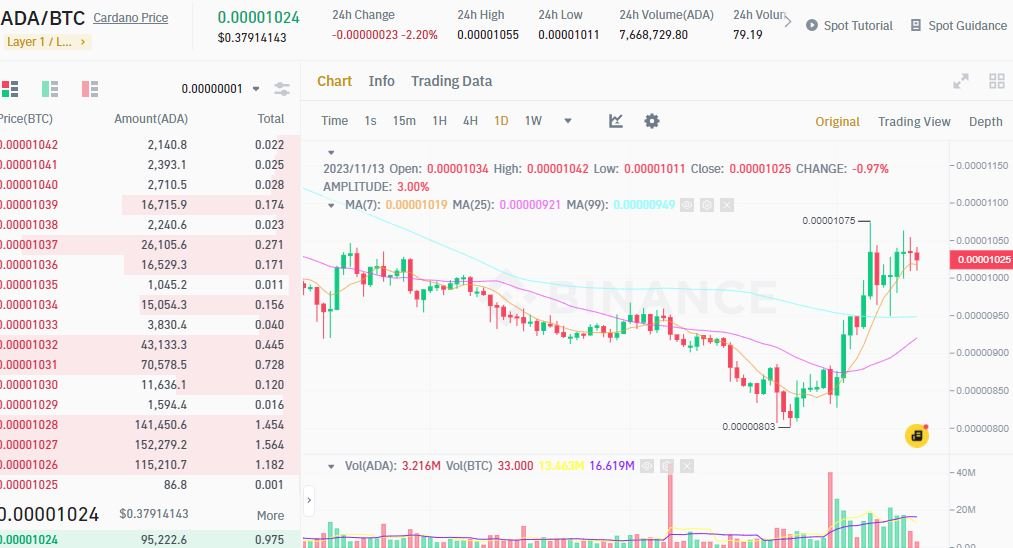

Crypto-Cross Pairs

These pairs involve trading between two cryptocurrencies, bypassing the need to convert to fiat currency. Crypto-cross pairs like ETH/BTC or LTC/ETH allow investors to diversify their crypto holdings and leverage the relative strengths and weaknesses of different cryptocurrencies against each other.

Quote vs Base Currency

In every trading pair, the base currency (first in the pair) is what you buy or sell, and the quote currency (second in the pair) is what you use to make the transaction. For example, in BTC/USD, BTC is the base currency, and USD is the quote currency. The price displayed for the pair indicates how much of the quote currency is required to buy one unit of the base currency.

Buy and Sell Price of a Crypto Pair

Ticker Symbols

Each crypto pair has a ticker symbol that uniquely identifies it in the market. This symbol is a shorthand representation of the pair, essential for traders to monitor and analyze market movements efficiently.

How to Read Pairs and Place a Trade Today

Step 1: Open an Account With a Crypto Broker

Identify a reputable cryptocurrency broker or exchange platform that matches your trading needs. Look for factors like security, ease of use, trading fees, and customer support when making your choice.

Step 2: Fund Your Crypto Trading Account

Once your account is set up, add funds to it. This could be in the form of fiat currency through methods like wire transfers or credit card payments, or by transferring existing cryptocurrencies into your new account.

Step 3: Browse Crypto Pairs

Explore the available crypto pairs on the platform. Different exchanges offer various pairs, so choose one that provides the specific pair you are interested in trading.

Step 4: Buy or Sell Order

Decide whether to buy or sell based on your market analysis and predictions. A buy order is placed if you believe the base currency will increase in value against the quote currency, and a sell order if you think it will decrease.

Step 5: Enter Stake and Place Crypto Trade

Enter the amount you wish to invest in the trade and confirm your order. Ensure you manage your risk appropriately by not investing more than you can afford to lose.

How to Read Pairs: The Bottom Line

Reading and understanding crypto pairs is a critical skill for any trader. It allows you to interpret market trends, make informed decisions, and execute trades that align with your investment strategy.

FAQs:

How do you Read Currency Pairs?

Reading currency pairs involves understanding the relationship between the base and the quote currency. The value indicates how much of the quote currency is required to buy one unit of the base currency.

How do Currency Pairs Work?

Currency pairs facilitate the trading of currencies on financial markets. They indicate the value of one currency relative to another, allowing traders to speculate on currency movements and exchange one currency for another.

How do you Trade Currency Pairs?

To trade currency pairs, select a pair, analyze market conditions, decide on a buy or sell position, and execute your trade through a brokerage platform.

What are the Seven Significant Pairs in Forex?

The seven major Forex pairs are EUR/USD, USD/JPY, GBP/USD, USD/CHF, AUD/USD, USD/CAD, and NZD/USD. These pairs have the highest trading volumes and are heavily traded on the global Forex market.

How do you Read EUR USD?

EUR/USD is read by determining how many US dollars (USD) are needed to purchase one Euro (EUR). For instance, if EUR/USD is 1.20, it means 1 Euro is equivalent to 1.20 US dollars.

What are the Four Currency Pairs?

The four major currency pairs in the Forex market are EUR/USD, USD/JPY, GBP/USD, and USD/CHF. These pairs are the most traded worldwide and are considered relatively stable.

A currency pair chart visually represents the price movements between two currencies over a specified period. It typically displays data points such as opening and closing prices, highs and lows, and can include various indicators used in technical analysis.

How do you Calculate Pips?

Pips (Percentage in Point) represent the smallest price move in a currency pair. In most pairs, a pip is equivalent to a 0.0001 change in value. For example, if EUR/USD moves from 1.1850 to 1.1851, that 0.0001 USD rise in value is one pip.

Which Currency is Used in Pairs?

In Forex trading, major world currencies like the US Dollar (USD), Euro (EUR), and Japanese Yen (JPY) are commonly used. In crypto trading, popular currencies include Bitcoin (BTC), Ethereum (ETH), and fiat currencies like the USD.

Which Forex Pair is Most Profitable?

The most profitable Forex pair can vary depending on market conditions. Generally, major pairs like EUR/USD and USD/JPY are popular for their liquidity and lower spreads but can be less volatile than minor or exotic pairs.