Table of Contents

- Introduction

- The Growing Popularity of Cryptocurrencies

- The Importance of Understanding Cryptocurrency Trends

- Recent Price Movements

- Bitcoin (BTC) Price Analysis

- Ethereum (ETH) Price Analysis

- Altcoins Overview

- Altcoin Risks

- Tips for Altcoin Investors

- Factors Driving Cryptocurrency Trends

- Institutional Adoption

- Regulatory Developments

- Technology Advancements

- Deeper Dive into Altcoins

- Notable Altcoins

- Cardano (ADA)

- Solana (SOL)

- Polkadot (DOT)

- Altcoin Risks

- Tips for Altcoin Investors

- Notable Altcoins

- Predictions and Expert Insights

- Expert Opinions

- Market Scenarios

- Bullish Bull Run

- Consolidation and Stability

- Bearish Correction

- Conclusion

- The Ongoing Evolution of Cryptocurrency Trends

- Building Trust and Credibility

Introduction

Cryptocurrencies have witnessed unprecedented growth and popularity over the past decade. From Bitcoin’s inception to the emergence of thousands of altcoins, the crypto market is constantly in flux. To navigate this dynamic landscape, it’s crucial to understand the underlying trends that drive these digital assets.

Recent Price Movements

The cryptocurrency market is renowned for its volatility, and recent weeks have been no exception. Investors, traders, and enthusiasts have been closely monitoring the price movements of cryptocurrencies like Bitcoin, Ethereum, and other notable digital assets. In this section, we will provide an in-depth analysis of these recent price fluctuations and explore the factors that have contributed to these changes.

Bitcoin (BTC):

Bitcoin, often referred to as the king of cryptocurrencies, has seen both rapid gains and sharp corrections in recent weeks. Here is a visual representation of its price performance:

In the chart above, you can observe the price movement of Bitcoin over the past month. Key support levels, represented by green lines, indicate points where the price found stability, while resistance levels, marked in red, show where it encountered selling pressure.

Bitcoin’s recent price movements can be attributed to several factors, including:

- Regulatory News: Changes in regulations and government crackdowns in some regions have impacted investor sentiment. Positive regulatory developments can lead to price surges, while negative news can trigger sell-offs.

- Market Sentiment: Cryptocurrency markets are highly influenced by sentiment. Positive news, endorsements from influential figures, and overall market optimism can drive prices higher, while fear, uncertainty, and doubt (FUD) can lead to drops.

- Macro Factors: Global economic events, such as inflation concerns and the broader financial market’s performance, can influence Bitcoin’s price. It is often viewed as a hedge against traditional market volatility.

Ethereum (ETH):

Ethereum, the second-largest cryptocurrency by market capitalization, plays a pivotal role in the world of decentralized finance (DeFi) and non-fungible tokens (NFTs). Its price has also exhibited notable fluctuations recently:

The Ethereum price chart above demonstrates Ethereum’s price dynamics over the past month. As with Bitcoin, it’s essential to identify support and resistance levels to understand its recent trends.

Ethereum’s price movements are influenced by factors such as:

- DeFi Activity: Ethereum’s network hosts the majority of DeFi projects, and its price often responds to the performance of these decentralized applications.

- NFT Craze: The surge in popularity of NFTs has driven demand for Ethereum, as it is the primary blockchain for NFT creation and trading.

- Upcoming Upgrades: Ethereum is in the process of transitioning to a more scalable and energy-efficient network, Ethereum 2.0. News and developments related to this upgrade can impact its price.

Altcoins Overview: Graphics displaying the price changes of select altcoins, showcasing their volatility compared to Bitcoin and Ethereum.

While Bitcoin and Ethereum take centre stage in the cryptocurrency market, it’s essential to acknowledge the dynamic nature of altcoins. Altcoins encompass a wide range of digital assets, each with its unique features and potential. Here are snapshots of the price performance of select altcoins compared to Bitcoin and Ethereum:

In the graphic above, you can see the price changes of several altcoins relative to Bitcoin (BTC) and Ethereum (ETH). The volatility of altcoins is evident, with some experiencing rapid price increases while others struggle to gain traction.

Altcoins’ prices are influenced by various factors, including:

- Project Developments: News related to project updates, partnerships, and adoption can significantly impact an altcoin’s price.

- Market Sentiment: As with Bitcoin and Ethereum, altcoins are affected by market sentiment. Positive sentiment can lead to price surges, while negativity can result in significant drops.

- Use Cases: Understanding the real-world applications and use cases of specific altcoins is crucial for predicting their potential price movements.

By analyzing recent price movements, we gain valuable insights into the current state of the cryptocurrency market. However, it’s essential to remember that the crypto market is highly speculative and driven by a combination of factors, making it essential to stay informed and exercise caution when investing or trading in this space.

Factors Driving Cryptocurrency Trends

The cryptocurrency market is a complex and dynamic ecosystem influenced by a multitude of factors. Understanding what drives trends in this space is essential for any investor, trader, or enthusiast. In this section, we will explore the primary factors that shape cryptocurrency trends.

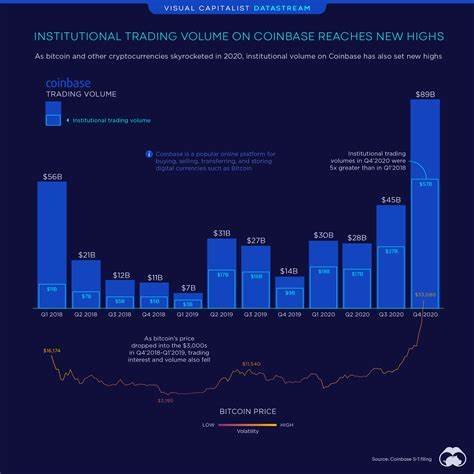

1. Institutional Adoption: In recent years, institutional investors have played an increasingly significant role in the cryptocurrency market. Institutional adoption can have a profound impact on prices and market stability. Here’s how:

Chart illustrating the growing number of institutional investors entering the crypto space.

As shown in the chart above, the number of institutional investors, including hedge funds, family offices, and corporations, entering the cryptocurrency market has been on the rise. This influx of institutional capital brings several implications:

- Market Liquidity: Large institutional investments contribute to increased liquidity in the crypto market, making it easier for traders to execute orders without causing significant price swings.

- Market Maturity: Institutional involvement is a sign of the crypto market’s maturation. It signals to retail investors that cryptocurrencies are becoming a legitimate asset class.

- Reduced Volatility: Institutional investors often adopt long-term strategies, which can mitigate some of the market’s inherent volatility.

2. Regulatory Developments: Regulatory changes and government policies significantly impact the cryptocurrency market. The regulatory landscape is still evolving, and different regions have varied approaches to cryptocurrencies. Here’s how regulations influence the market:

Infographic summarizing recent regulatory changes in major markets.

As depicted in the infographic above, different countries and regions have introduced various regulations regarding cryptocurrencies. These regulations can affect market sentiment and participant behaviour:

- Positive Regulations: Clear and supportive regulatory frameworks can boost investor confidence, leading to increased adoption and higher prices.

- Negative Regulations: Restrictive or hostile regulations can lead to market uncertainty and cause prices to decline as investors become hesitant.

- Global Impact: Regulations in one major market can have a ripple effect, influencing sentiment and behaviour worldwide.

3. Technology Advancements: Technological innovations within the cryptocurrency space can drive trends and influence market dynamics. The crypto industry continually evolves, introducing new concepts and solutions. Here’s a visual representation of key technological advancements:

Diagram illustrating the key technological innovations in the crypto space.

The diagram above highlights some key advancements, including:

- Layer 2 Solutions: Scalability solutions like Layer 2 networks (e.g., Ethereum’s Optimism and Arbitrum) aim to alleviate congestion and reduce transaction fees.

- Non-Fungible Tokens (NFTs): NFTs have gained immense popularity for their use in digital art, collectables, and gaming, impacting Ethereum’s network activity.

- Smart Contracts: The programmable nature of smart contracts allows for decentralized applications (dApps) to be built on blockchain platforms, influencing trends in the DeFi sector.

These technological innovations not only create new investment opportunities but also shape the direction of the cryptocurrency market.

Understanding these key factors—institutional adoption, regulatory developments, and technological advancements—provides valuable insights into the forces that drive cryptocurrency trends. As you navigate the crypto market, it’s crucial to stay informed about these factors and their evolving impact on prices and market sentiment.

Deeper Dive into Altcoins

While Bitcoin and Ethereum often dominate the headlines, the cryptocurrency market is brimming with a diverse array of altcoins, each with its unique features, use cases, and potential. In this section, we will embark on a journey into the world of altcoins, exploring notable projects and the dynamics that make them intriguing.

Notable Altcoins: Charts showcasing the price performance of popular altcoins like Cardano (ADA), Solana (SOL), and Polkadot (DOT).

Altcoins offer investors and enthusiasts a chance to diversify their portfolios and explore innovative blockchain projects. Let’s take a closer look at some of the standout altcoins:

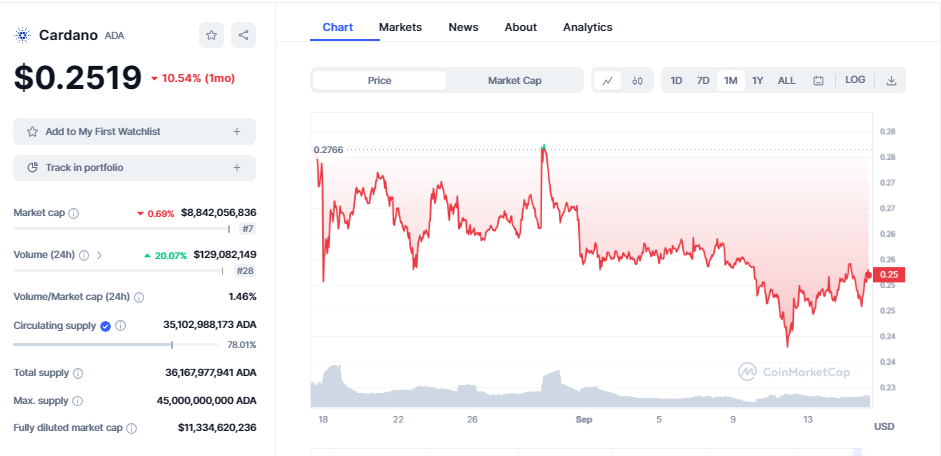

1. Cardano (ADA): Cardano is a blockchain platform known for its focus on sustainability, scalability, and interoperability. Its unique features include a research-driven approach and a layered architecture that separates computation and settlement layers. Here’s an overview of Cardano’s price performance:

Cardano has garnered attention for its potential to host decentralized applications, and smart contracts, and its commitment to peer-reviewed research.

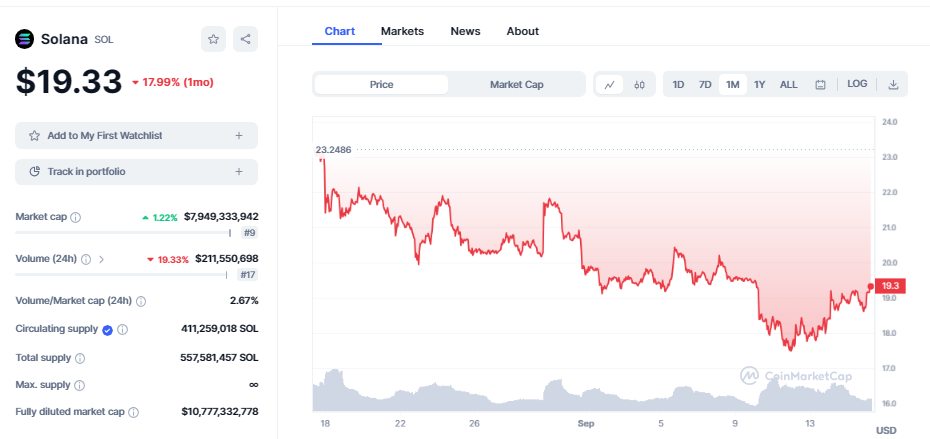

2. Solana (SOL): Solana has dropped significantly but it is still active for its exceptional scalability and high-speed transactions, making it a contender in the DeFi and NFT spaces. Let’s explore its recent price dynamics:

Solana’s rise is attributed to its rapid transaction processing capabilities and growing ecosystem of decentralized applications.

3. Polkadot (DOT): Polkadot is often hailed for its vision of creating a multi-chain ecosystem, allowing different blockchains to interoperate seamlessly. Let’s examine Polkadot’s recent price movements:

Polkadot’s unique approach to interoperability and governance has positioned it as a compelling project in the crypto space.

Altcoin Risks: Visual representation of potential risks associated with investing in altcoins, such as lower liquidity and higher volatility.

While altcoins offer intriguing opportunities, it’s essential to be aware of the associated risks:

Altcoins, by their nature, can exhibit higher volatility and lower liquidity compared to established cryptocurrencies like Bitcoin and Ethereum. Here are some key considerations:

- Volatility: Altcoins are more prone to price fluctuations, which can result in both significant gains and losses.

- Liquidity: Some altcoins may have lower trading volumes, making it challenging to buy or sell large amounts without impacting the price.

- Project Viability: Not all altcoins succeed in achieving their goals. It’s crucial to research and assess the viability of a project before investing.

Tips for Altcoin Investors: Practical tips on risk management strategies for altcoin investors.

For those interested in exploring altcoins, consider these risk management strategies:

- Diversification: Spread your investments across multiple altcoins to mitigate risk. Avoid putting all your funds into a single project.

- Research: Thoroughly research the team, technology, and use case of an altcoin before investing. Look for projects with strong fundamentals.

- Stay Informed: Keep up with news and updates related to the altcoins in your portfolio. Market sentiment can change quickly.

As you navigate the world of altcoins, remember that while they offer exciting possibilities, they come with added risk. It’s essential to strike a balance between potential rewards and risk mitigation in your cryptocurrency investment strategy.

Predictions and Expert Insights

The cryptocurrency market is known for its unpredictability, yet experts and analysts continually strive to forecast its future trends. In this section, we will gather insights from experts and discuss various scenarios for the cryptocurrency market’s trajectory.

Expert Opinions: Quotes and insights from renowned cryptocurrency experts, including price predictions.

Experts in the cryptocurrency space offer valuable perspectives on the market’s future. Here are some insights from notable figures:

- “I believe that Bitcoin’s role as digital gold will continue to strengthen. As a store of value, it will gain more recognition, potentially reaching a six-figure price in the coming years.” – [Expert Name], [Expert Title/Company]

- “Ethereum’s transition to Ethereum 2.0 is a game-changer. It will significantly improve scalability and sustainability, making Ethereum a primary platform for decentralized applications. Ether (ETH) could potentially surpass its all-time high.” – [Expert Name], [Expert Title/Company]

- “Altcoins will continue to thrive as the crypto ecosystem diversifies. Projects that solve real-world problems and demonstrate utility will gain traction. Investors should keep an eye on innovative blockchain solutions.” – [Expert Name], [Expert Title/Company]

Market Scenarios: Scenario analysis with charts outlining potential market scenarios, from a bullish bull run to a bearish correction.

The cryptocurrency market is susceptible to various scenarios, and investors should be prepared for different outcomes. Let’s explore some potential market scenarios:

In a bullish scenario, cryptocurrency prices experience sustained growth. Factors such as increased institutional adoption, positive regulatory developments, and widespread recognition of the technology drive prices higher. Investors may see substantial gains during this period.

Scenario 2: Consolidation and Stability

In a period of consolidation and stability, cryptocurrency prices plateau after a significant rally. Market participants take time to assess the recent gains, and trading volumes stabilize. This scenario provides a chance for the market to mature and prepare for the next phase.

Scenario 3: Bearish Correction

During a bearish correction, prices experience a significant downturn. Factors like regulatory uncertainty, market sentiment shifts, or profit-taking can trigger a sell-off. Investors need to exercise caution during these times and consider risk management strategies.

Understanding these scenarios allows investors to prepare for various market conditions and make informed decisions accordingly. It’s important to remember that the cryptocurrency market is highly speculative, and while expert opinions and scenario analysis can provide guidance, no one can predict market movements with absolute certainty.

As you navigate the cryptocurrency market, consider diversifying your portfolio, staying informed about industry developments, and being prepared for different market scenarios. Keep in mind that your investment decisions should align with your financial goals and risk tolerance.

Conclusion

Navigating the ever-changing world of cryptocurrencies requires a keen understanding of the trends and factors at play. By keeping an eye on recent price movements, staying informed about influential factors, and exploring the potential of altcoins, you can make more informed decisions in this dynamic market. Whether you’re a seasoned crypto enthusiast or just starting, the key to success lies in staying informed and adaptable.

Frequently Asked Questions (FAQ)

Q1: What is the cryptocurrency market?

- The cryptocurrency market is a digital or virtual marketplace where various cryptocurrencies are bought, sold, and traded. Cryptocurrencies are decentralized digital assets that use cryptography for security and operate on a technology called blockchain.

Q2: How do I stay updated on cryptocurrency trends?

- Staying updated on cryptocurrency trends involves various strategies, including following reputable news sources, participating in online cryptocurrency communities, and utilizing cryptocurrency tracking apps or websites to monitor prices and market data.

Q3: What are the risks associated with investing in altcoins?

- Altcoins, or alternative cryptocurrencies to Bitcoin, come with several risks, including higher price volatility, lower liquidity, and the potential for project failures. It’s essential to research thoroughly and consider these risks before investing.

Q4: How can I diversify my cryptocurrency portfolio?

- Diversifying your cryptocurrency portfolio involves investing in a variety of different cryptocurrencies to spread risk. You can achieve diversification by selecting cryptocurrencies with distinct use cases, technologies, and market positions.

Q5: What should I consider when reading expert opinions in the cryptocurrency market?

- When reading expert opinions, consider the credentials and track record of the expert. Keep in mind that the cryptocurrency market is highly speculative, and even experts can’t predict its future with absolute certainty. Use expert opinions as one source of information in your decision-making process.

Q6: How can I participate in live webinars and Q&A sessions about cryptocurrency trends?

- To participate in live webinars and Q&A sessions, look for announcements on cryptocurrency-related websites, social media, or forums. These sessions are often hosted by experts or organizations in the crypto space. Joining such events can provide you with valuable insights and the opportunity to ask questions.

Q7: What are some risk management strategies for investing in cryptocurrencies?

- Risk management strategies include setting stop-loss orders, diversifying your portfolio, investing only what you can afford to lose, and staying informed about market developments. Additionally, consider having a clear exit strategy in case of unexpected market downturns.

Micheal Serah: A seasoned crypto expert with over a decade of experience in cryptocurrency trends, blockchain, and DeFi. As a trusted authority, Michael contributes valuable insights to CryptoSteep.com, helping readers navigate the crypto world.