Crypto Market vs. Stock Market: Key Differences Explained

The cryptocurrency market has been gaining traction in recent years, with many investors choosing to diversify their portfolios by investing in digital assets. However, the stock market remains a popular investment option for many individuals. While both markets offer the potential for high returns, there are key differences between the two that investors should be aware of.

One of the main differences between the crypto market and the stock market is the level of regulation. The stock market is highly regulated, with companies required to disclose financial information and meet certain standards to be listed on major exchanges.

On the other hand, the crypto market is largely unregulated, with few rules in place to protect investors. This lack of regulation can make the crypto market more volatile and risky compared to the stock market.

Another key difference is the underlying asset. In the stock market, investors are buying ownership in a company, with the potential for dividends and capital appreciation.

In the crypto market, investors are buying digital assets that are not tied to any underlying company or asset. Instead, the value of cryptocurrencies is largely determined by market demand and supply. This can make the crypto market more speculative compared to the stock market.

Understanding the Basics

When it comes to investing, two popular markets are the stock market and the crypto market. While both markets involve buying and selling assets in the hopes of making a profit, there are some key differences between the two. This section will provide an overview of the basics of the stock market and the crypto market.

What is the Stock Market?

The stock market, also known as the equity market, is a platform where publicly traded companies issue and trade their stocks. When a company goes public, it offers a portion of its ownership to the public in the form of stocks.

These stocks can then be bought and sold by investors, allowing them to own a piece of the company and potentially make a profit if the company performs well.

The stock market is heavily regulated, with strict rules and regulations in place to ensure transparency and fairness. The market is also highly influenced by economic and political events, as well as company-specific news such as earnings reports and product launches.

What is the Crypto Market?

The crypto market, also known as the cryptocurrency market, is a platform where digital assets are bought and sold. Cryptocurrencies are decentralized, meaning that they are not controlled by any government or financial institution. Instead, they are based on blockchain technology, which allows for secure and transparent transactions.

Unlike the stock market, the crypto market is largely unregulated, with few rules and regulations in place. This can make it more volatile and unpredictable, as prices can fluctuate rapidly based on market sentiment and speculation.

Another key difference between the two markets is the types of assets that are traded. While the stock market trades stocks, the crypto market trades cryptocurrencies such as Bitcoin, Ethereum, and Litecoin.

These digital assets can be used for a variety of purposes, including as a form of payment, as a store of value, or as a speculative investment.

In summary, the stock market and the crypto market are two distinct markets with their own unique characteristics. While both markets involve buying and selling assets in the hopes of making a profit, the stock market is heavily regulated and trades stocks, while the crypto market is largely unregulated and trades cryptocurrencies.

Key Differences

When it comes to investing, there are different types of markets available, including the cryptocurrency market and the stock market. While both markets involve buying and selling assets, there are several key differences between them.

Regulation

One of the biggest differences between the cryptocurrency market and the stock market is the level of regulation. The stock market is heavily regulated by government agencies, such as the Securities and Exchange Commission (SEC), which helps to protect investors from fraud and ensure that companies follow certain standards.

On the other hand, the cryptocurrency market is largely unregulated, which means that investors have to be more careful when investing in these assets. While some countries have started to regulate cryptocurrencies, the market is still largely unregulated, which can make it more risky for investors.

Volatility

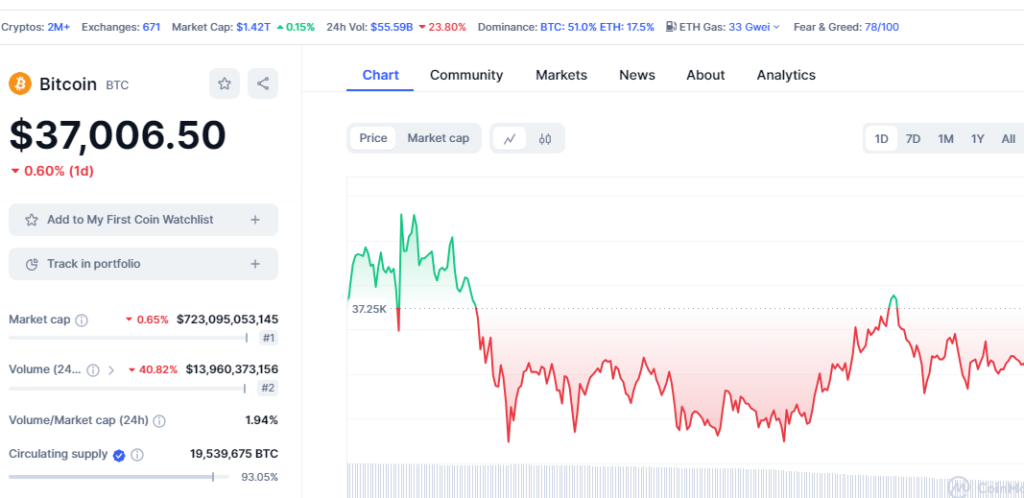

Another key difference between the cryptocurrency market and the stock market is the level of volatility. Cryptocurrencies are known for their extreme price fluctuations, which can make them more risky for investors.

The value of cryptocurrencies can change rapidly based on a variety of factors, including market sentiment, news events, and government regulations.

In contrast, the stock market tends to be less volatile, with prices changing more gradually over time. While there are still risks involved in investing in the stock market, the level of volatility is generally lower than in the cryptocurrency market.

Market Hours

The stock market is open during specific hours, typically from 9:30 am to 4:00 pm Eastern Time, Monday through Friday. Outside of these hours, investors cannot buy or sell stocks. In contrast, the cryptocurrency market is open 24/7, which means that investors can buy and sell cryptocurrencies at any time of the day or night.

Accessibility

Finally, there is a difference in accessibility between the cryptocurrency market and the stock market. Investing in the stock market typically requires a brokerage account, which can come with fees and other restrictions. In contrast, anyone with an internet connection can invest in cryptocurrencies, which makes it more accessible to a wider range of investors.

Overall, while both the cryptocurrency market and the stock market involve buying and selling assets, there are several key differences between them. Investors should carefully consider these differences when deciding which market to invest in.

Pros and Cons

Advantages of Stock Market

The stock market is a well-established and regulated market that has been around for centuries. It offers investors a variety of advantages, including:

- Liquidity: Investors can easily buy and sell stocks on the stock market, making it a highly liquid market.

- Diversification: Investors can diversify their portfolio by investing in a variety of stocks across different industries and sectors.

- Transparency: The stock market is highly regulated, and companies are required to disclose financial information to the public, making it a transparent market.

Disadvantages of Stocks Market

While the stock market offers many advantages, there are also some disadvantages, including:

- Volatility: The stock market is known for its volatility, and stock prices can fluctuate wildly in response to economic and political events.

- Insider trading: Insider trading is a serious problem in the stock market, and it can be difficult to detect and prosecute.

- High fees: Investing in the stock market can be expensive, with high fees charged by brokers and other intermediaries.

Advantages of Crypto Market

The crypto market is a relatively new and unregulated market that offers investors a different set of advantages, including:

- Decentralization: The crypto market is decentralized, meaning that it is not controlled by any central authority or government.

- Anonymity: Transactions in the crypto market are anonymous, providing users with a high level of privacy and security.

- Low fees: Transactions in the crypto market are typically low-cost, with no intermediaries or brokers involved.

Disadvantages of Crypto Market

While the crypto market offers many advantages, there are also some disadvantages, including:

- Volatility: The crypto market is highly volatile, and prices can fluctuate wildly in response to news and events.

- Lack of regulation: The crypto market is largely unregulated, making it vulnerable to fraud and other illegal activities.

- Complexity: The crypto market can be complex and difficult to understand, with many different cryptocurrencies and blockchain technologies to choose from.

In summary, both the stock market and the crypto market offer investors a unique set of advantages and disadvantages. Investors should carefully consider their investment goals and risk tolerance before deciding which market to invest in.

Investment Strategies

When it comes to investment strategies, the stock market and crypto market have some key differences. Here are some strategies that investors use for each market.

Stock Market Investment Strategies

In the stock market, investors often use fundamental analysis to evaluate a company’s financial health and growth prospects. This involves looking at financial statements, earnings reports, and other data to make informed investment decisions. Some common stock market investment strategies include:

- Value investing: This involves looking for undervalued stocks that have strong fundamentals but are trading at a lower price than their intrinsic value.

- Growth investing: This involves investing in companies that are expected to grow faster than the overall market.

- Index investing: This involves investing in a broad-based index fund that tracks a specific stock market index, such as the S&P 500.

Crypto Market Investment Strategies

In the crypto market, investors often use technical analysis to evaluate the price movements of cryptocurrencies. This involves looking at charts and other data to identify patterns and trends. Some common crypto market investment strategies include:

- HODLing: This involves buying and holding a cryptocurrency for the long term, regardless of short-term price fluctuations.

- Day trading: This involves buying and selling cryptocurrencies within a single day to take advantage of short-term price movements.

- Swing trading: This involves buying and holding a cryptocurrency for a few days or weeks to take advantage of medium-term price movements.

It’s worth noting that both markets can be volatile and unpredictable, so investors need to do their research and invest wisely.

Future of the Stock Market

The future of the stock market is promising, with many experts predicting that it will continue to grow in the coming years. The global economy is expected to recover from the COVID-19 pandemic, which will lead to increased investor confidence and higher stock prices. Additionally, advances in technology and innovation are likely to boost the stock market, with companies in sectors such as healthcare, renewable energy, and artificial intelligence expected to perform well.

However, there are also concerns about the future of the stock market. One major risk is the possibility of another economic recession, which could lead to a decline in stock prices. Additionally, there is growing scrutiny of the environmental, social, and governance (ESG) practices of companies, which could lead to increased regulation and lower stock prices for companies that do not meet ESG standards.

Future of Crypto Market

The future of the crypto market is also promising, with many experts predicting that it will continue to grow in the coming years. The increasing adoption of cryptocurrencies by mainstream financial institutions and the growing interest from retail investors are expected to drive growth in the market.

Additionally, the development of decentralized finance (DeFi) and non-fungible tokens (NFTs) is expected to open up new use cases for cryptocurrencies.

However, there are also concerns about the future of the crypto market. One major risk is the possibility of increased regulation, which could lead to a decline in the value of cryptocurrencies.

Additionally, the volatility of the market and the lack of clear regulations and standards could deter institutional investors from entering the market.

Overall, both the stock market and the crypto market have promising futures but also face risks and challenges that could impact their growth. It is important for investors to carefully consider these factors when making investment decisions.

Frequently Ask Questions.

What is the difference between the crypto and stock market?

The crypto market revolves around the trading of digital assets known as cryptocurrencies, like Bitcoin and Ethereum, which are decentralized and often utilize blockchain technology.

The market is known for its high volatility and operates 24/7, allowing for constant trading without the need for a formal exchange.

In contrast, the stock market involves buying and selling shares of publicly traded companies through established stock exchanges like the NYSE or NASDAQ.

Stocks represent a stake in a company’s assets and earnings. The stock market is regulated by financial authorities, has set trading hours, and is influenced by different factors, including company performance and economic indicators.

What are the similarities between the crypto and stock market?

Despite their differences, the crypto and stock markets share several similarities. Both markets operate on the principles of supply and demand, where prices are influenced by buyer and seller activities. Investors in both markets aim to buy low and sell high to make a profit.

Both markets are also subject to speculative trading and can be influenced by investor sentiment, media coverage, and market trends.

How do market regulations differ between crypto and stock markets?

Market regulations are a significant point of divergence between the crypto and stock markets. The stock market is well-regulated by governmental bodies, such as the Securities and Exchange Commission (SEC) in the United States, which oversees and enforces securities laws to protect investors and maintain fair, orderly, and efficient markets.

On the other hand, the crypto market is relatively less regulated, with the rules and guidelines still in a state of evolution. The lack of comprehensive regulation in the crypto space can lead to a higher risk of fraud and market manipulation.

However, this is changing as more countries are beginning to develop and implement regulatory frameworks for cryptocurrencies.

Can investors use the same strategies in both the crypto and stock markets?

Investors might find that some strategies can indeed be applied to both markets. These include fundamental analysis, where investors look at economic indicators, market trends, and company or asset-specific news to make informed decisions.

Technical analysis, which relies on statistical trends and chart patterns, is also commonly used in both markets.

However, due to the inherent differences in asset types, volatility, market maturity, and trading hours, certain strategies may work differently in each market. For example, strategies that rely on market timing need to be adapted to the 24/7 nature of the crypto market, as opposed to the stock market’s set trading hours.

Conclusion

the cryptocurrency market and the stock market represent two fundamentally different investment landscapes. The stock market, with its stringent regulations, offers investors a degree of protection and stability through established financial systems and disclosure requirements.

It is characterized by its more traditional assets—stocks that represent ownership in companies and may yield dividends. Conversely, the cryptocurrency market, known for its decentralization, operates with minimal regulation, resulting in a more volatile environment.

Cryptocurrencies, as digital assets, have their value determined by supply and demand dynamics rather than inherent company performance, which can lead to speculative investment behaviour.

Investors navigating these markets must consider the contrasting levels of regulation, volatility, market hours, and accessibility. The stock market’s regulated environment and set trading hours provide a structured investment experience, while the crypto market’s unregulated, always-on nature offers greater flexibility at the cost of higher risk and unpredictability.