Mastering Trading Psychology: Strategies for Emotional Control & Market Success

Key takeaways: To deepen your understanding of trading psychology and its impact on your investment decisions, it might be beneficial to start by evaluating your emotional responses to market movements. Have you noticed patterns in your behaviour that you’d like to change? Additionally, consider looking into psychological tools and techniques that traders use to maintain emotional equilibrium. Would you be interested in exploring specific strategies to manage emotions like fear or greed in trading scenarios?

Understanding Trading Psychology is crucial for anyone who wants to succeed in the financial markets. Crypto trading is not just about analyzing charts and making decisions based on technical or fundamental analysis. It is also about understanding human behaviour, emotions, and biases.

As such, traders need to have a good grasp of psychology to make informed decisions and manage their risk effectively.

Psychology plays a significant role in the crypto market because it affects how traders perceive and react to market movements. For example, traders who are prone to fear and anxiety may panic and close their positions prematurely, leading to losses.

On the other hand, overconfident traders may take excessive risks and trade impulsively, leading to a similar outcome. Therefore, Understanding Trading Psychology can help traders avoid making irrational decisions and improve their overall performance.

In addition to managing emotions and biases, understanding the psychology of trading can also help traders develop better trading strategies. By analyzing market sentiment and understanding how other traders are likely to behave, traders can anticipate market movements and take advantage of opportunities.

Moreover, traders who understand the psychology of trading can also use it to identify potential market trends and patterns, which can help them make more informed decisions.

Applying Trading Psychology in decision making

Trading psychology refers to the emotional and mental state of a trader when making trading decisions. It is a crucial aspect of trading that can significantly impact a trader’s success or failure in the market.

One of the most important aspects of trading psychology is understanding the role of emotions in trading. Emotions such as fear, greed, and hope can significantly influence a trader’s decision-making process. For example, fear can cause a trader to exit a trade too early, while greed can lead to holding onto a trade for too long, resulting in losses.

Traders need to develop the ability to control their emotions and make rational decisions based on market analysis and strategy. This requires discipline and a deep understanding of one’s own emotions and how they can impact trading decisions.

Another critical aspect of trading psychology in crypto is risk management. Traders need to have a clear understanding of the risks involved in trading and develop a risk management strategy that suits their trading style and risk tolerance. This includes setting stop-loss orders, managing position sizes, and diversifying their portfolio.

Traders also need to have a positive mindset and be able to handle losses and setbacks. They need to understand that losses are a natural part of trading and that they can learn from their mistakes. A positive mindset can help traders stay focused and motivated, even during difficult times.

In summary, understanding trading psychology is essential for any trader who wants to be successful in the market. It involves developing the ability to control emotions, manage risk, and maintain a positive mindset. By mastering trading psychology, traders can improve their decision-making process and increase their chances of success in the market.

The Role of Trading Psychology in the Crypto Market

Market psychology refers to the emotions and attitudes that influence financial market participants, leading to certain behaviours and investment decisions. It is a critical factor in trading, as it can cause significant market movements and impact the performance of individual traders.

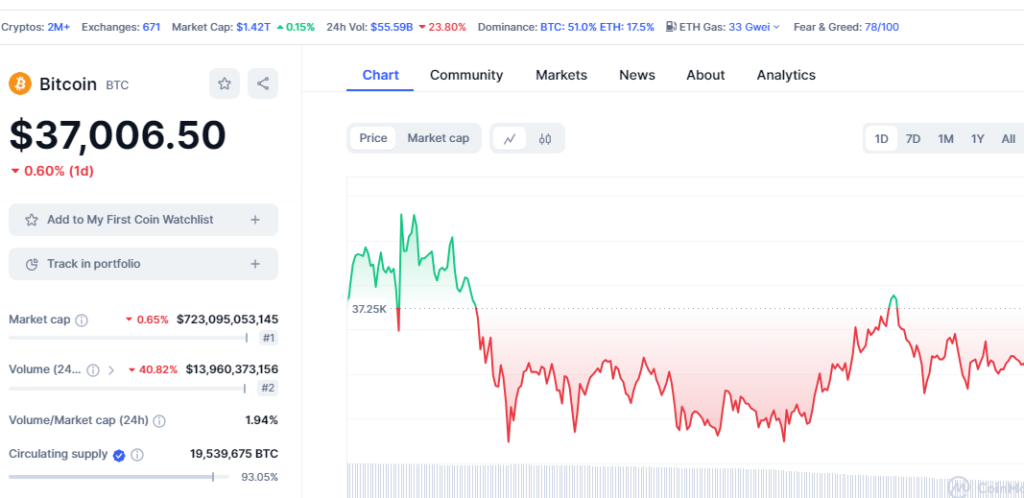

One way to understand market psychology is through market psychology charts, which track the sentiment of investors over time. These charts can help traders identify trends and patterns in market behaviour, allowing them to make more informed decisions.

Market psychology can also impact the way traders approach risk management. For example, fear of missing out (FOMO) can cause traders to take on excessive risk in an attempt to capitalize on a perceived opportunity, while fear of loss can cause traders to exit positions prematurely.

Understanding market psychology is essential for successful trading. Having a grasp of market psychology is crucial for achieving trading success. Traders who can identify and manage their own emotions and biases, as well as those of the broader market, are more likely to make profitable trades.

In summary, market psychology plays a significant role in trading, influencing the behavior of individual traders and the broader financial market. Traders who can effectively manage their emotions and biases, as well as those of the market, are more likely to make profitable trades. Market psychology charts can be a useful tool for tracking investor sentiment and identifying trends in market behaviour.

The Mindset of a Successful Trader

One of the essential components of this is developing the right mindset. A successful trader must have a positive attitude, be disciplined, and have a clear understanding of their goals and risk tolerance.

A trader’s mindset can be the difference between success and failure. Successful trader has a mindset that allows them to stay calm and focused, even during volatile market conditions. They are not swayed by emotions or market noise and make decisions based on logic and analysis.

Successful traders also understand the importance of risk management. They know how to manage their emotions and avoid making impulsive decisions that can lead to losses. They set realistic goals and are disciplined enough to stick to their trading plan.

Another important aspect of a successful trader’s mindset is the ability to learn from their mistakes. They understand that losses are a part of trading and use them as an opportunity to learn and improve their trading strategy.

Portfolio Diversification to make profitable trades

In addition to these traits, successful traders also have a deep understanding of portfolio diversification. They know how to read market trends and know when to buy more than one coin or trade which can help them make profitable trades. They also understand the impact of news and events on the market and use this knowledge to their advantage.

Overall, developing the right mindset is critical to becoming a successful trader. It takes discipline, patience, and a willingness to learn and adapt to changing market conditions. By focusing on developing a positive mindset and incorporating sound risk management practices, traders can increase their chances of success in the markets.

Trading Psychology and the Stock Market

Psychology plays a significant role in the stock market. Understanding the psychology of trading is essential to make informed investment decisions. The stock market is not just about numbers and statistics; it is also about emotions, perceptions, and beliefs. The way people think and feel about the market can have a significant impact on their investment decisions.

One of the key psychological factors that affect the stock market is fear. Fear can cause investors to panic and sell their shares, leading to a decline in the market. On the other hand, greed can cause investors to overlook the risks and invest in high-risk stocks, leading to a bubble that eventually bursts.

Another psychological factor that affects the stock market is herd mentality. Investors tend to follow the crowd and make investment decisions based on what others are doing. This can lead to a situation where the market is overvalued or undervalued, leading to a correction in the market.

Psychology also plays a role in how investors perceive information. Investors tend to focus more on information that confirms their beliefs and ignore information that contradicts their beliefs. This can lead to a situation where investors overlook important information that could affect their investment decisions.

In conclusion, understanding the psychology of trading is essential to making informed investment decisions in the stock market. Investors need to be aware of their emotions, biases, and beliefs and how they affect their investment decisions. By understanding the psychology of trading, investors can make better investment decisions and avoid costly mistakes.

FAQ

How do you get good at trading psychology?

To excel in trading psychology, you need to develop emotional discipline, patience, and the ability to stick to a trading plan. Practice mindfulness and self-reflection to become aware of emotional triggers and biases that can affect trading decisions.

Consistently reviewing your trades to learn from successes and failures also helps in honing a trader’s psychological edge.

How do I start understanding Trading Psychology

Begin with the basics of financial markets and the principles of supply and demand. Educate yourself on different trading instruments, such as stocks, forex, or commodities.

Utilize resources like books, online courses, and trading simulators. It’s essential to learn technical analysis for chart reading and fundamental analysis to understand the economic factors affecting markets.

What are Psychological levels in trading?

Psychological levels refer to price levels in financial markets that are significant in the psychology of the market participants. These are typically round numbers (e.g., 1.3000 in forex or 100 in stocks) that traders pay close attention to, often resulting in increased buying or selling pressure when these levels are approached or breached.

Conclusion

Understanding the psychology of trading is crucial for any trader who wants to become successful in the market. While many factors contribute to trading success, a trader’s mindset and emotional state are often the most important.

Through the use of various tools and techniques, traders can develop a better understanding of their psychology and learn to manage their emotions in a way that allows them to make rational and profitable trading decisions. This includes developing a trading plan, setting realistic goals, and maintaining discipline and patience.

It is also important for traders to recognize the role that biases and heuristics can play in their decision-making process. By acknowledging and addressing these biases, traders can make more objective and informed decisions, which can ultimately lead to greater success in the market.

Overall, understanding the psychology of trading is an ongoing process that requires self-reflection, discipline, and a willingness to learn and adapt. By developing a strong understanding of their own psychology and the psychology of the market, traders can increase their chances of success and achieve their financial goals.